The best services for the management of your company

Enterprise Risk

Management

Cost Allocation Analysis

And Design

Financial and Tax

Reporting

Compliance

Financial

Reconciliations

We are a company with passionate finance professionals

Enterprise Risk Management

Enterprise Risk Management is defined by the US Committee Of Sponsoring Organizations Of Treadway Commission (COSO) as a process, effected by an entity’s board of directors, management and other personnel, applied in strategy setting and across the enterprise, designed to identify potential events that may affect the entity, and manage risks to be within its risk appetite, to provide reasonable assurance regarding the achievement of entity objectives. COSO divides ERM process into eight components:

- Internal environment,

- Objective setting,

- Event identification,

- Risk assessment,

- Risk response,

- Control activities,

- Information and communication, and

- Monitoring.

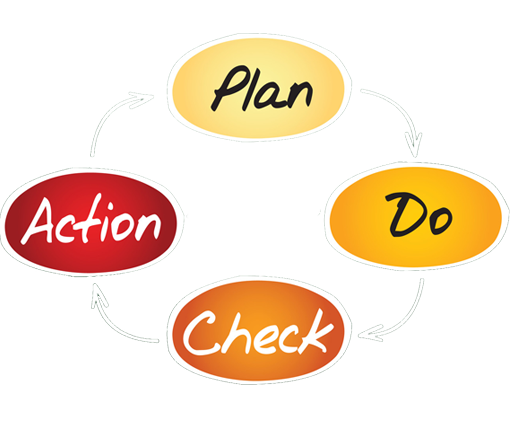

Like many Sarbanes-Oxley compliance models and approaches, most ERM models are big, complex, and cost too much. Bringabout has developed a straightforward, understandable approach to ERM. Our approach utilizes the COSO ERM Framework. This framework provides guidance on how to develop a disciplined and sustainable risk management process that is easily integrated with existing risk and/or control processes already in place (such as Sarbanes-Oxley, etc.).

Our ERM model’s intent is to move a company from a passive risk management process to a formalized, embedded total ERM program where management makes decisions based on a proactive analysis and understanding of the potential risks and outcomes impacting the decision. We take a strategic view of ERM from management’s perspective with a primary objective of increasing shareholder value.

It is important that ERM be implemented in a way that is consistent with the company’s objectives and is done in a cost-effective manner. While the use of predictive modeling can be an extremely potent tool, a targeted approach to its use is best. As with any initiative that has the potential to be extremely complex and costly, we recommend keeping it simple and practical.

Bookkeeping Services/VAT/Payroll Outsourcing

Bringabout provides monthly, quarterly or annual accounting to businesses for which in-house bookkeeping is not practical. We provide financial statements with supporting general ledger, accounts receivable, and accounts payable reports. We also assist clients with the preparation of periodic filings such as VAT.

- Accounting Software selection and implementation

- Bookkeeping Services

- VAT/Payroll outsourcing

Cost Allocation Analysis And Design

Bringabout’s Finance Teams are ready to offer an array of services to fulfill your optimization needs. The optimization process is typically the implementation of the recommendations from an Assessment Phase, with the goal of enabling better executive decision-making through financial transparency.

Whether the need is to address a small subset of reporting challenges or make sweeping organization changes, we can streamline costs and improve efficiency in the Finance Department. The actual optimization effort may include introduction of a new software product or implementation of new policies and procedures.

Specific activities typically taken by our teams include:

- Chart of account design / review

- Cost allocation analysis and design

- Finance policies and procedures development

Financial And Tax Reporting

We help our customers by providing genuine oversight of the process for setting accounting and auditing standards as well as monitoring the effectiveness of your requirements on their financial reporting.

Bringabout’s Financial Reporting Team can help bring clarity to a company’s reporting needs. Organizations can be under tremendous scrutiny; even minor issues can impact its business valuation. It is critical to be aware of any such issues as soon as possible so that executives may take appropriate actions to protect the value of the company, ensure the security of the employees, and maintain the faith of stakeholders.

If your company struggles with the monthly, quarterly, or annual close process, then consider talking with a Bringabout financial representative. We can assess your specific needs and current processes and leverage our wide variety of industry experience to:

- Streamline your financial reporting process;

- Ensure the reports meet you and your stakeholders’ needs;

- Improve the efficiency of your Finance Department.

Bringabout can also provide temporary Financial Reporting outsourcing services for companies with urgent needs. We can fulfill your regular reporting requirements and help plan, hire, and guide a new Finance department.

We have expertise in:

- Chart of account review and design

- Cost allocation analysis and design

- Finance policies and procedures

Compliance

Our Compliance Program is one of the key components supporting our commitment to high standards of corporate conduct. Risk management is increasingly becoming a main topic of concern in today’s business world. New laws, regulations and court rulings – combined with the challenges of living up to Sarbanes-Oxley rules – present significant risks to companies in terms of compliance laws, market performance and strategic goals.

We provide specific answers to the increased pressure on corporations to develop and implement compliance programs. We will assist you in developing a compliance program strategy that includes training, communications, reporting, and other activities to increase the success and effectiveness of your compliance program. We bring expertise in helping you select the appropriate vendors for developing course content, translating content into different languages, and selecting the appropriate on-line tools.

Under the leadership of the Chief Compliance Officer, the Compliance Program is multi-layered and dynamic.

Financial Reconciliations

Bringabout’s Finance Team can review your current financial reporting procedures and recommend changes and improvements. We’ll ensure that your reports are designed to meet you and your stakeholders’ needs. Our consultants will implement the appropriate safeguard procedures, in accordance with current best practices, guidelines, and regulations.

Reconciliation or verification of financial transactions is a key element of your internal controls and is fundamental to sound business practices. A verification of all charges against a cost object, accompanied by any necessary corrections, ensures the fundamental transactions, which result in financial reports, are correct.

The establishment of a regular Financial Reconciliation process is a mandatory component of any financial plan today. A regular process will ensure that financial reports are done in a consistent manner and will limit the occurrence of revenue adjustments. Companies should be aware of the repercussions of significant adjustments or restatements. The value and reputation of the company and its executive team can be damaged and the issues not easily overcome.

Our Finance Team will help you with your end-to-end account reconciliation, including automated reconciliation for high volume, transaction-intensive accounts and template-based reconciliation for any remaining accounts. We will provide state-of-the-art account reconciliation software solution for high-volume account matching. This reconciliation software will automate daily, monthly, and periodic reconciliation and account balancing to help your organization increase efficiencies and reduce the costs needed for reconciliations, tighten controls, reduce risk, leverage cash, and make more informed decisions.

We help our clients achieve:

- Accurate, complete, and timely financial reports

- Faith in the personnel and policies associated with report generation

- Documented procedures to help withstand external scrutiny and audits

- Reduced occurrence of revenue adjustments and restatements

Contact Us | Go to Management Services